Stürzt China die Weltwirtschaft ins Chaos?

- Lesezeichen für Artikel anlegen

- Artikel Url in die Zwischenablage kopieren

- Artikel per Mail weiterleiten

- Artikel auf X teilen

- Artikel auf WhatsApp teilen

- Ausdrucken oder als PDF speichern

„We continue to view China as the biggest source of macro risk: A number of key macro indicators have improved (PMIs, macro surprises), but many others have not.“

Gründe die zur Vorsicht mahnen:

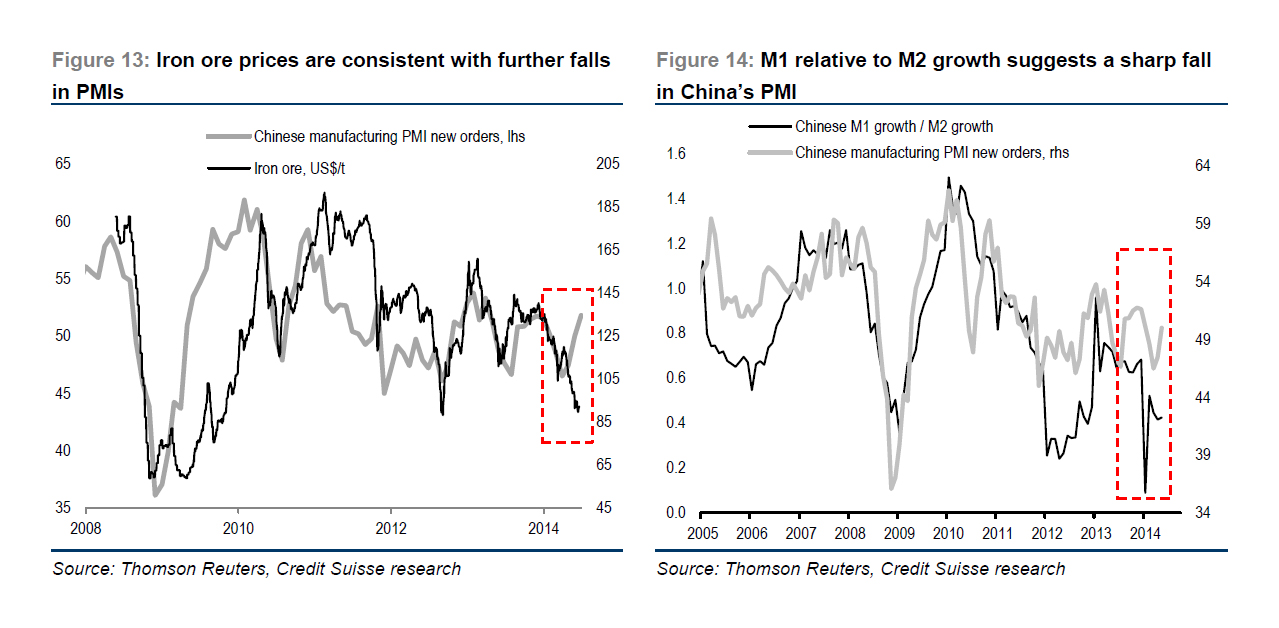

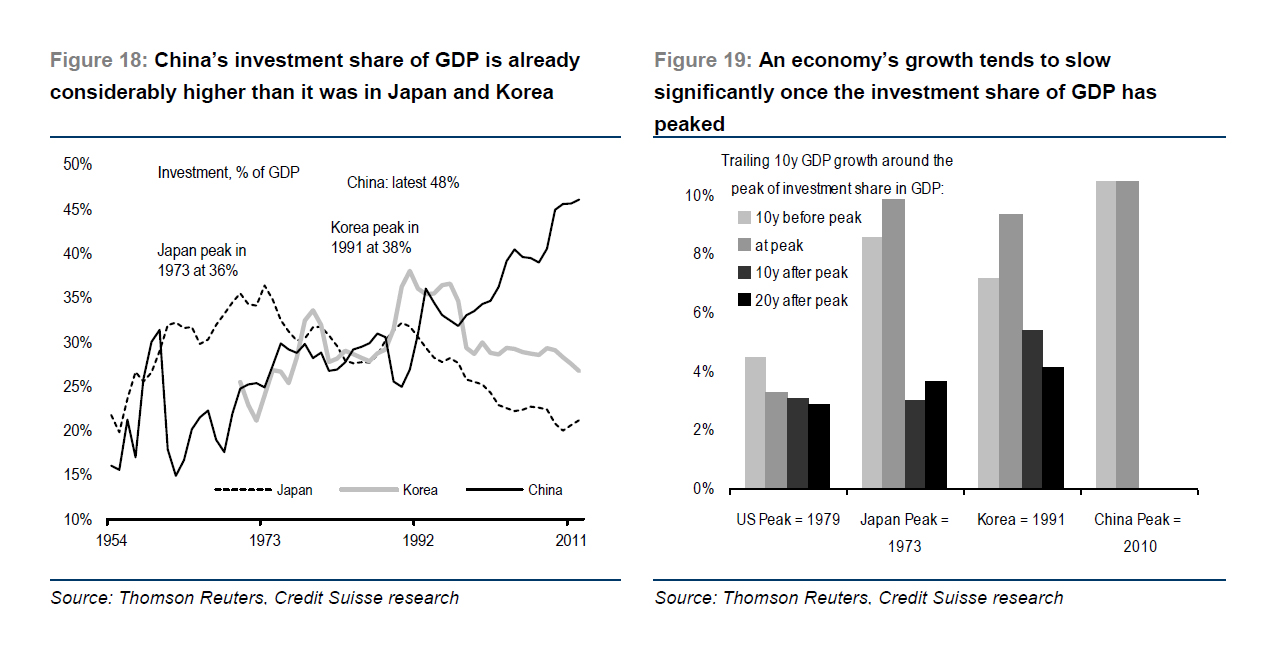

1) Divergenz bei Eisenerz und neuen Aufträgen, genauso wie bei dem Wachstum von M1 relativ zu M2.

„The ratio of job vacancies to applicants has risen to close to an all-time high of 1.11, with our economists highlighting that the shortage of workers is concentrated among manual rather than white collar workers. This, when combined with a working age population that is now falling, suggests there are underlying upward pressures on wages.“

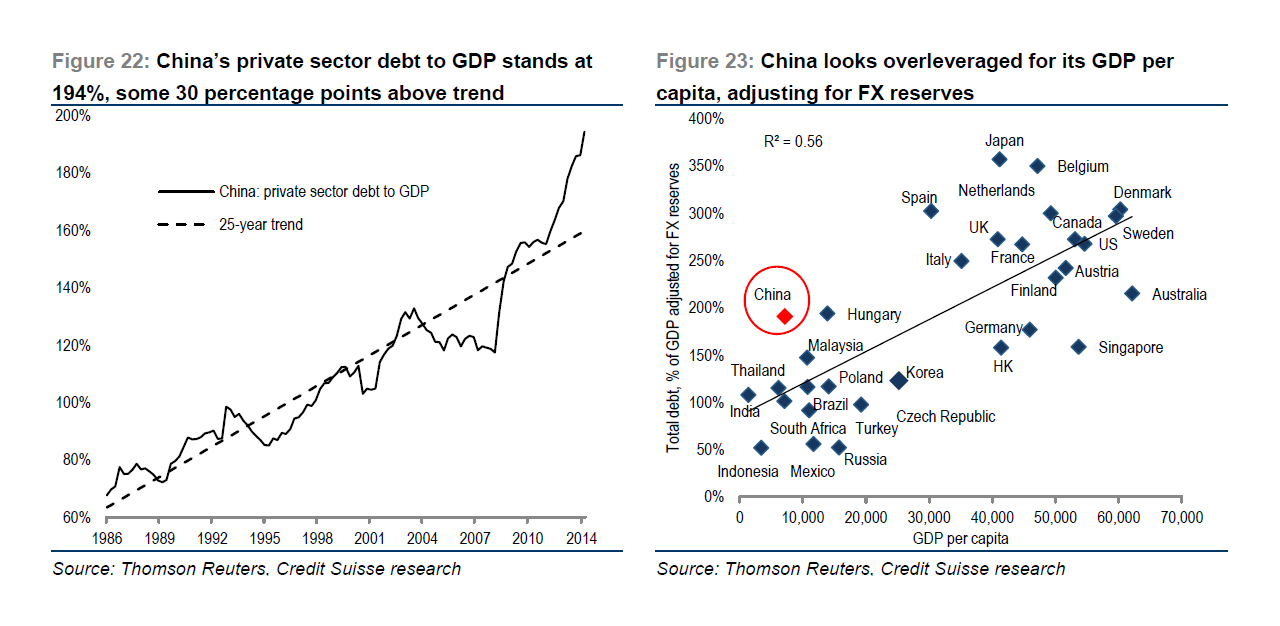

5) Die riesige Kreditblase im Privatsektor

„China's private sector debt to GDP ratio stood at 194 % of GDP in Q1, some 30 percentage points above its 25-year trend, compared to a deviation of 15 percentage points in the US in 2008 and with BIS research suggesting that a deviation of more than 10 percentage points tends to signal an increased risk of financial trouble ahead.“

6) Eine nicht mehr wettbewerbsfähige Währung:

„We have seen signs of a slowdown in export growth and, according to BCG, China is now only 4 % cheaper as a manufacturing base than the US.“

7) Steigende Zinsen im Interbankenmarkt:

„We are a little concerned that following a period of declining interbank rates, they have recently started to rise again. One-month SHIBOR has risen from a trough of 3.71 % on 3 June to 5.4 % now.“

Credit Suisse geht im Baseline-Szenario trotzdem davon aus, dass ein „Hard Landing“ aus zwei Gründen vermieden werden kann:

1) Fiskalische Flexibilität:

„Government debt to GDP is likely to be much higher than the official audited figure of 56 % of GDP, in our view. However, with nominal GDP growth still nearly double the 10-year bond yield (7 % versus 3.6 %), China is in a position to be able to afford to finance a government debt to GDP ratio of 170 %.“

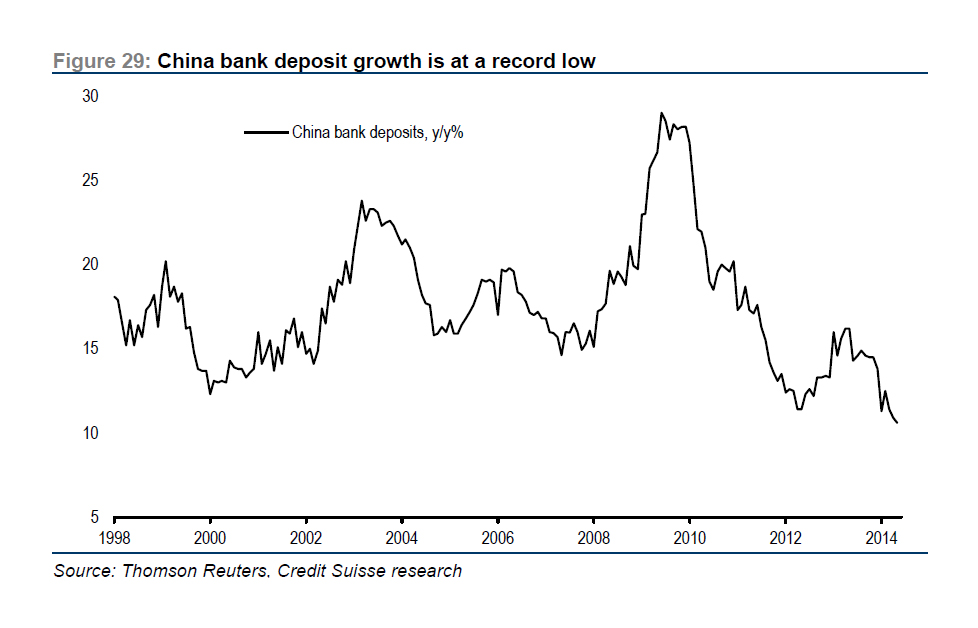

2) Deposit Inflows

„While there are concerns over the shadow banking system, which now accounts for a third of total credit, the key is that 70 % of total lending occurs via the banking system. The Prime Lending rate in the banking system is still 6 % and in many instances SOEs are borrowing at 5 %. They are able to borrow at such low rates because the cost of deposits for banks is just 2 % . Currently, there is deposit growth of 10.6 % year on year despite the competition for deposits from the likes of Yue’E Bao of 5 %“

Für einen Kollaps der Wirtschaft bedarf es laut Credit Suisse zweier Voraussetzungen:

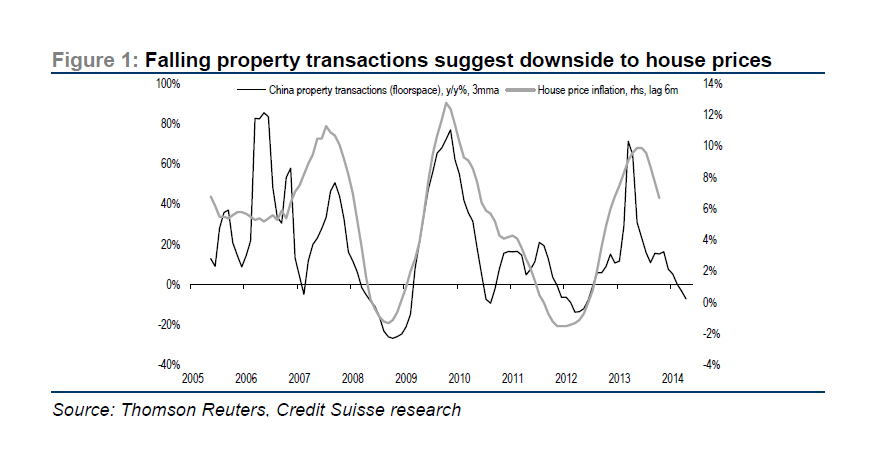

1) Sinkende Häuserpreise um mehr als 20 %. Dies würde die faulen Kredite auf 20 % hochschnellen lassen, welche dann mit 40 % der Wirtschaftsleistung nationalisiert werden müssten. Die einzige Antwort darauf wäre Geld drucken im großen Stil.

2) Deposit Outflows - wenn Kunden anfangen ihre Einlagen abziehen, müssten Banken ihre Zinsen anheben.

Beide Indikatoren sollten also engmaschig verfolgt werden.

Ein wenig Kontext: Habe vor einigen Tagen einen exzellenten Artikel von der China-Expertin Ann Lee gelesen. Sie geht nicht von einem Crash aus. China hat ähnlich wie die USA eine gewaltige Kriegsmaschine und eine Zentralbank, und ist daher im Prinzip unzerstörbar. Sie sieht größere Risiken in den USA.

http://www.bjreview.com/print/txt/2014-07/07/content_628047.htm

Die jüngste Barclays-Umfrage unter institutionellen Investoren hat geopolitische Risiken als Hauptsorge der Investoren genannt. Sie haben China also aktuell nicht mehr auf dem Bildschirm. Vom 24. Juni:

The main worry for market participants is geopolitics rather than growth or Fed tightening, according to a survey of 941 global investors conducted by Barclays. 35% of investors believe that geopolitical developments are the most important risk to financial markets over the next 12 months. By contrast, in the last two surveys, investors thought China/EM growth and Fed policy withdrawal were the main risks (Figure 1). This suggests that surprises on the macro front (eg, growth, inflation or monetary policy) could be more damaging than commonly perceived. We have discussed these risks and their implications for markets in recent publications (see, for example, Global Asset Allocator: Positioning for positive sentiment after the ECB put, 10 June 2014).

Investors are becoming more upbeat about the prospects for growth and inflation. About 40% believe that growth surprises are likely to be positive, and most think they are likely to come from the US. Investors’ perceptions of deflation/inflation risks have also shifted. Most investors now believe inflation to be a bigger risk than deflation, the opposite of the last two surveys (Figure 2). The mood is slightly less upbeat for Chinese growth: most investors still expect growth to be 7-7.5% but about 30% now see it below 7% (Figure 3). That said, investors no longer see weaker Chinese growth as a significant risk.

The survey also shows an increasing preference for growth-linked assets. Commodities are now seen as the best performing asset by close to 20% of investors, up from less than 10% at the turn of the year. EM equity is now seen as the most attractive investment by 26% of equity investors, a major swing from Q1 when only 9% thought they would outperform other regions. Finally, growth-linked equities are seen as the favoured equity sector.

Central bank policy is seen as a major factor behind low vol and other market trends. A large majority of investors believe low market volatility is a function of very easy central bank policy and is likely to stay close to record lows in the next few months. However, 36% of them believe low vol is likely to be at an important turning point in the next three to six months. We share this concern and believe that Fed tightening expectations will lead to higher volatility. According to the survey, most expect the first Fed hike in Q2 15, broadly in line with market expectations. And most do not see the need for core PCE inflation to rise above the Fed’s 2% target for the first hike to occur. Meanwhile, however, they also see Chair Yellen as a major influence in keeping rates low relative to the views of the rest of the FOMC (eg, as reflected in the ‘dots’ projections). Over in Europe, the recent ECB actions have already led to material market moves. Nonetheless, market participants see plenty of room for EUR/USD to weaken and for peripheral equities to rally following these actions.