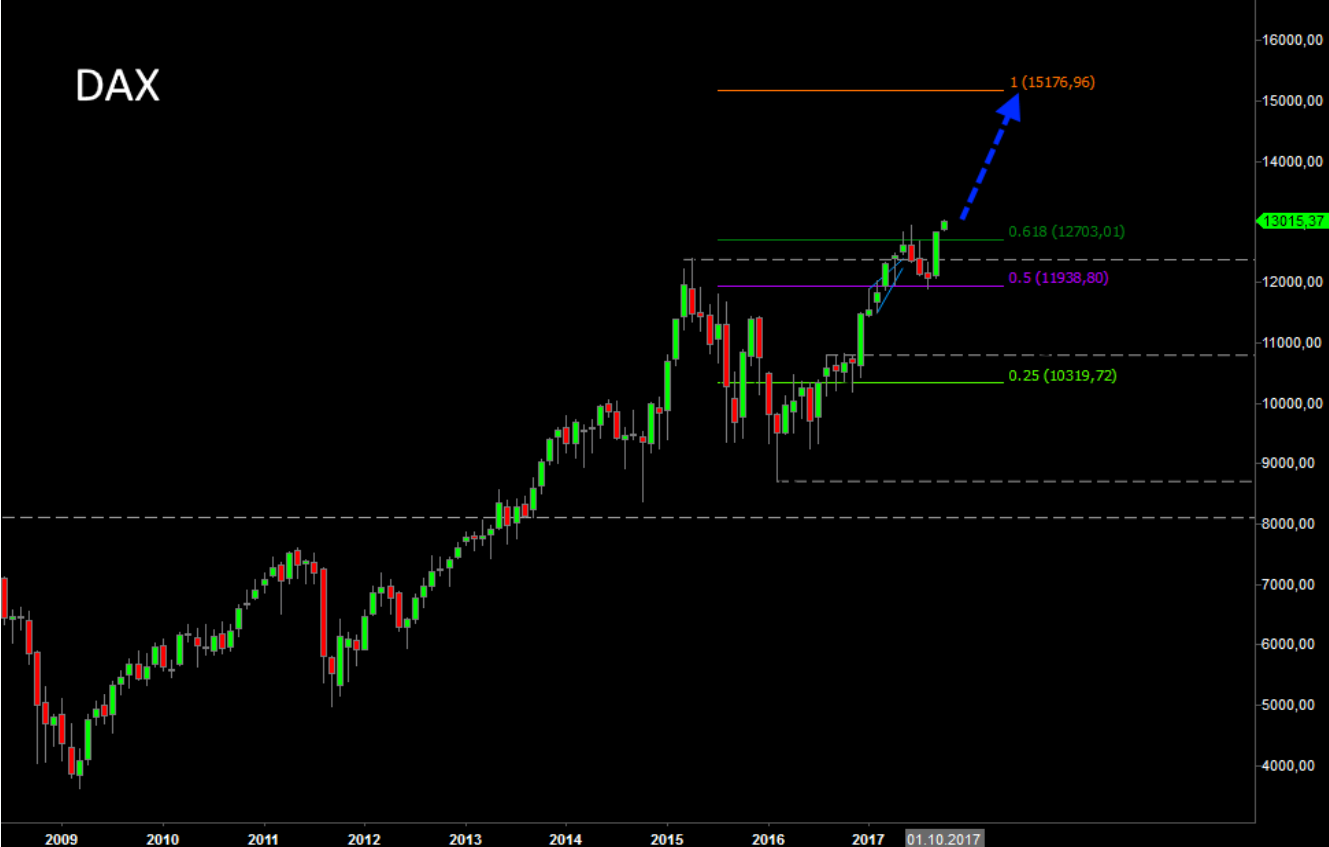

DAX - Frühjahrsrally 2018

- Lesezeichen für Artikel anlegen

- Artikel Url in die Zwischenablage kopieren

- Artikel per Mail weiterleiten

- Artikel auf X teilen

- Artikel auf WhatsApp teilen

- Ausdrucken oder als PDF speichern

Erwähnte Instrumente

- DAX - WKN: 846900 - ISIN: DE0008469008 - Kurs: 13.290,80 Pkt (XETRA)

Ausgangspunkt des Konters im DAX war die leicht abfallende (rot markierte) Unterstützungslinie bei 12.750 Punkten. Der Konter ist stark und dynamisch, also eher nicht nur ein "Dead cat bounce" auf besagter Unterstützungslinie. Der Index steht nach 3 starken Handelstagen an dem Widerstand bei 13.300 Punkten. Kommende Woche kann es in diesem Bereich zu einem Abpraller nach unten kommen. Denkbar ist auch, - um es den kurzfristigen Tradern schwer zu machen - , dass sie erst über 13.300 ansteigen und dann nochmals zurückfallen. Anschließend dürfte es aber im Rahmen einer Frühjahrserholung ein Stück höher gehen in Richtung 13.850. Bei 13.850 Punkten liegt zum einen das klassische Projektionsziel aus der Range unterhalb von 13.300 Punkten, zum anderen verläuft hier eine mehrjährige deckelnde Widerstandslinie.

02.01.2018 - 11:43 Uhr EUR/USD - Trump schießt den Euro langfristig auf 1,6000 $

Reminder: "Im langfristigen Zeitfenster hat der DAX ein Ziel bei 15.176 Punkten offen". S. Kurzanalyse, die unten als Kopie angehängt ist.

Über 17.000 Trader folgen mir und meinen täglichen Ausführungen auf Guidants. Auch Sie sind eingeladen, mir kostenlos zu folgen: Bitte hier klicken. Auf Guidants melde ich immer zuerst, wenn ich neue Signale im Markt sehe.

Bedienungsanleitung für Guidants: Bitte hier klicken

DAX Big Picture Chart: Ziel 15.176 Punkte, aber kurzfristig?

25.12.2017 - 16:43 Uhr

Das ist die DAX Big Picture Prognoseskizze, die ich zuletzt auf Veranstaltungen präsentiert habe. Im langfristigen Zeitfenster hat der DAX ein Ziel bei 15.176 Punkten offen, der Dow Jones eins bei 29.726. Viele kurz- und mittelfristige Wege führen nach Rom, darunter leider auch echte Umwege. Insofern ist die Information als kurzfristiger Trader mit der nötigen Vorsicht zu genießen. Dennoch: Meines Erachtens sind die europäischen und US Aktienmärkte noch nicht "oben" angekommen.

World of Trading 2024: Triff die stock3-Experten live vor Ort

Am 22. & 23.11. findet die World of Trading in Frankfurt statt & stock3 ist mit dabei. Wir laden Dich ein, uns & unsere Experten näher kennenzulernen. Mit dabei sind u.a. Bastian Galuschka, Sascha Gebhard u.v.m.

Passende Produkte

| WKN | Long/Short | KO | Hebel | Laufzeit | Bid | Ask |

|---|

GE0RG1. . . MERKEL RUNS FROM RESPONSIBILITY FOR NOW AS THERE IS DEBT OF SOME 1 TRILLION DOLLARS AUSTRIA CANNOT SERVICE WELL INVESTED MAINLY IN CEE, ALSO SOME 0.91 TRILLIONS TARGET 2 GIVEN TO OTHER EU COUNTRIES TO SUBSTITUTE LEAVING DEPOSITS DIFFICULT TO COLLECT BACK , AS WELL AS GERMANY BANKS LOST A LOT OF DEPOSITS THAT THE NEXT GOVERNMENT HAS TO ADMIT TOGETHER WITH A LOT OF ILLEGALLY PRINTED MONEY BY ECB THAT LEAD TO HYPERINFLATION SPIRAL. No one else will buy recklessly junk bonds to collect them with force so EU will fall apart without Merkel , so the circles behind her push her strongly to be premier to keep their share bubble and wealth and all others run away to support her or take responsibility of reckless investments and loans she is so confused and greedy that may expect even I to pay them. Check Target 2 data these days for last month as I describe, I suppose they may be cheated by ECB fear of happening deposit run. Deposits leaving EU banks , rationing is coming in EU. USA may steal them so diversify. See how EUR declines 20 % close to currency crisis 25 % and ECB bluffs with interventions these days. Catalonia banks move their headquarters and may very soon impose deposit rationing. Then all EU will expect deposit rationing for them and deposits will leave. Bundesbank's TARGET2 claims increase a lot to some 0.91 trillions at end September 2017 according to monthly updated by them website where you can also see time series as Germany should not be able to provide much more means for mainly Spain , Italy but also Portugal , Greece banks in trouble to cover for their non reversible process of leaving deposits you may find on line. There will be soon deposit rationing in EU as the ECB bluff for growth and election changes in France , Germany does not work. . . . Require deposit rationing from Draghi as his friends will try to take complete deposits out and the loss of banks and costs for refinancing leaving deposits will be paid by you. There are some trillion loss for some trillion deposits left and most Europeans realize such connection as they move deposits ..See low prices of banks in EU as proof for trillions of assets. Main loss is coming from bad loans in eastern Europe some of the greatest in the world and bad prospects for growth in EU due to high government debts and wage rigidities. Follow Austrian banks telecoms as EU tries to sell lemons first. Greek banks are bankrupted with assets in Eastern Europe , Austrian banks work in the same region and their banks and telecoms data may be cheated . Follow also for illegal activities as money washing Austrian banks and telecoms. Follow EBRD condition , competence and fund mismanagement as well as all funds that cover eu sovereign bonds. Yellena may steal EU deposits. Ask them until when they will endanger the health of my family for the facts I reveal that endangers their financial markets forever. My family was moderately poisoned these days to scare me not to write here. - GE0RG1 POLITICAL SYSTEMS GAMBLE IN USA EU , FR DE UK IT ES PUT COMPLETE POLITICAL SYSTEM VS POPULISTS AS NOBODY TRUST THE GOVERNMENTS TODAY SIMILAR TO JOHN LAW A FRENCH FINANCE MINISTER THAT CLAIMED THAT HIS COMPANY CONNECTED WITH THE COUNTRY HAS BUILD HUGE PROJECT IN THE FIELDS OF MISSISSIPPI , YELLEN , TRUMP, DRAGHI , JUNCKER BLUFF THERE IS VERY STRONG GROWTH IN US , EU. When revealed that there are no projects in Mississippi , John Law escapes from France where the share bubble ends. Many finance minsters in Europe had similar sad destiny, do you remember also how Ceausescu run and Milosevic was hidden in a kindergarden. the political situation in usa and eu is that many presidents and ministers , central banker are determined to be the worst ever. This is true for USA president and Yellen fed head from cnbc survey as the lowest grade chairman. The French president approval declined at lowest place compared to all recent presidents , with similar situation in UK , Germany , Italy Spain, ECB , EC. Many of them stay to be blamed when deposit rationing is imposed in EU and the share bubble ends in USA to steal your deposits and savings reciprocally in EU and USA. Many politicians are supported by several political parties that puts the complete current political systems against populists as in France example. wiki Populism is a mode of political communication that is based on contrasts between the "common man" or "the people" and a real or imagined group of "privileged elites", traditionally scapegoating or making a folk devil of the latter. Populists can fall anywhere on the traditional left–right political spectrum of politics, and often portray both bourgeois capitalists and socialist organizers as unfairly dominating the political sphere. Populism is most common in democratic nations. Political scientist Cas Mudde wrote that " that populism is inherent to representative democracy; after all, do populists not juxtapose 'the pure people' against ' corrupt elite

GE0RG1 . . DEVIATE FROM ILLEGAL BUYBACK COLLISION AS COMPANY DEBT IS HUGE AND SELL YOUR SHARES NOW. THE PUBLIC WILL NOT BUY SHARES SO ONLY SOME OF THE COLLISION WILL BE CHEATED FOR BIG MONEY IN THE BUBBLE AS IN 2009 CRISIS. NOBODY OF THE COLLISION , TO BUY SHARES FOR MANIPULATING PRICES LAST YEARS , SHOULD BE AFRAID TO SELL THEIR SHARES NOW . FOLLOW SOME OF INVESTORS OR MANAGERS NOT TO END IN HOSPITAL OR BE PUNISHED MORE SEVERELY BY FED ECB AND OTHER COLLISION MEMBERS . Following Jeremy Grantham IRRATIONAL EXUBERANCE LOOKS LIKE BUBBLE BY 1.2 SHARE INCREASE IN YEAR ONE , NEED 1.3 YEAR TWO OR 2018 SHARE INCREASE TO OVERCOME 1.3 YEAR ONE DECLINE RISK , 1.5 YEAR 2 DECLINE RISK OBSERVED IN LAST TWO USA BUBBLES. SO NEED 1.3 OR MORE SHARE INCREASE IN 2018 BUT FROM IRRATIONAL EXUBERANCE OF THE PUBLIC NOT IMITATED WITH ILLEGAL PRINTING OF MONEY. FED PRINTS ILLEGALLY MONEY AND GAMBLES WITH THEM IN VAIN ON STOCK EXCHANGE THAT IS LOSS , NOT PROFIT AND IN THE END SOME OF COLLISION WILL BE CHEATED. MUNITIONS ARE OVER WITH SOME 7 TRILLIONS SPENT ON BUYBACK IN VEIN , SO RISK IS HIGH FOR INDEBTED COMPANIES TO BANKRUPT LEAVE EMPLOYEES ON STREET , AND MANAGERS KILL THEMSELVES AS IN 1029 CLASSIC WITH 50 % SHARES EXPECTED DECLINE . SHARES BOUGHT WITH PRINTED MONEY ARE NOT SOLD TO PUBLIC BUT RETAINED. NO MUNITIONS FOR 1.3 INCREASE IN 2018 , ONLY FED , ECB BLUFF AS USD WILL DECLINE IN CURRENCY CRISIS FAST AND INFLATION IN US , EU , UK INCREASE. COMPANIES WILL RISK A LOT WITH NEW TRILLION BUYBACK IN 2018 TO INCREASE THEIR DEBT. AS BEAR THAT ONCE TASTE MEAT IS MAN EATER, COMPANIES WILL EXPECT PRINTED MONEY THAT CANNOT BE PRINTED WITHOUT STRONG INFLATION. IN 2017 BUYBACK DOES NOT MOVE SP 500 UP AS SP 500 BUYBACK INDEX DO NOT INCREASE FASTER. HIGHER BONDS YIELDS DUE TO INFLATION MAKES SHARES LESS ATTRACTIVE. FED LAST BLUFF IS NEARLY OVER EXPLAINED WITH FAANG LOTTERY AND ILLEGALLY PRINTING MONEY THAT WILL PUT THE DOLLAR DOWN. TO BE SUCCESSFUL A BUBBLE ORGANIZED IN COLLISION THE SHARES SHOULD BE SOLD TO MIDDLE CLASS OR FOREIGNERS WHEN THE PRICES HAVE A LOT OF POSSIBILITY TO INCREASE. OTHERWISE A GAMBLE OF HALF MONEY VS 10 % INCREASE IS A LOTTERY NOT GOOD CHEATING BUBBLE. FED PRINTED ILLEGALLY A LOT OF MONEY AND NEARLY SPENT THEIR CURRENCY RESERVES. FOR THIS REASON THE GREED ON THE MARKETS DECLINES EXTREMELY FAST. For the last 2 months FED made a last attempt to bluff by printing illegally money and donating them to the commercial banks to invest in shares for a bubble , simultaneously intervening on the dollar market with commercial banks and FED currency reserves to keep the dollar nearly stable. All central banks in the world understood and returned currency reserves that puts the dollar vs the stock exchange. Before the last two months there was increase in New York Composite index for NYSE of some 10 % from the beginning of the year 2017 reciprocal to some 10 % decline of dollar ,so there is no profit in local or foreign currencies while foreigners move a lot of capital in and out of USA , and THE SECOND ELEMENT IS SOME INCREASE IN NASDAQ FROM FAANG MAINLY FOR 1 OR 2 TRILLIONS THAT SETS TEN AND MORE TIME HIGHER PE RATIOS FOR COMPANIES AS AMAZON AND NETFLIX. THIS IS NOT TULIP FROM TULIP MANIA SOMEONE TO GAMBLE WITH SMALL AMOUNT RISKING TIMES OF DECLINE VS SMALL CHANCE FOR PROFIT, NOBODY PUTS A LOT OF MONEY IN SUCH A GAMBLE , BUT ONLY MANIPULATE STOCK INDEXES. The USA banks got some bail out in advance with fed illegally printed money . This bubble was obviously not stable and doomed after some 3 years lost without growth of NYSE and some 7 trillions buyback wasted by organized as crime companies in USA for an illegal collision bubble. The situation is similar for EU and ECB , probably UK. ECB bluffed growth as fake correlated news for stock exchange increase and retaining leaving deposits. FED , ECB munitions for printing illegally money and currency reserves for interventions are ending soon as the bubble of shares and there is no more room for bluffing. Trump impeachment and Russian case is just a theater to destruct you from the real economic fundamental facts.

GE0RG1. ON FED , US BANKS , FAANG , STOCK MARKET LOTTERY . . . IF FED TRIES TO PRINT MONEY TO CREATE IRRATIONAL EXUBERANCE . . .MAIN STOCK EXCHANGE INDEXES IN USA LOOK MANIPULATED BY CONSTANTLY ADDED MONEY AS THOUGH SOME SHARES PRICES MOVE TO DETERMINE THE WHOLE INDEX DYNAMICS. AS THOUGH SOMEONE PLANS THE FINAL POINT IN TIME AND THERE IS NO VARIATION. ALL SHOCKS ARE HANDLED BY FED TO CREATE IRRATIONAL EXUBERANCE IN INVESTORS. Still after some 7 trillion buyback , rich hold nearly all shares they try to sell you before the next secular recession in usa and market decline and assume the loss , the level of households that markets as of now and profit from it for the rich. For 10 %decline of dollar in 2017 as some currency index there is the same increase in nyse composite index. For liquid asset as shares with a lot of capital movement it is normal the price and currency exchange to move 1 for 1. Some shares in sp 500 however increase more as faang mainly over the currency decline. There to be irrational exuberance one must believe that others accept their high price for fair. It is difficult to accept the faang pe ratios a fair especially amazon and netflix by 247 and 223. Behind these companies basically there is one recommendation algorithm or some other algorithm in distributes code for hadoop. Algorithms soon will turn into what internet become in 2000 market markets as of now and profit from it for the rich. For 10 %decline of dollar in 2017 as some currency index there is the same increase in nyse composite index. For liquid asset as shares with a lot of capital movement it is normal the price and currency exchange to move 1 for 1. Some shares in sp 500 however increase more as faang mainly over the currency decline. There to be irrational exuberance one must believe that others accept their high price for fair. It is difficult to accept the faang pe ratios a fair especially amazon and netflix by 247 and 223. Behind these companies basically there is one recommendation algorithm or some other algorithm in distributes code for hadoop. Algorithms soon will turn into what internet become in 2000 market crisis. They acquired as much clients as they could for now and utilize their data as much as they can so there is no huge space for improvement for increase in profits. The businesses can be replicated for this capitalization easily with cheap computers for hadoop. Facebook may utilize some more data , but they have to change the rules set by customers. China, Russian have their own search engine and social media for security reasons so the market is quite satisfied and utilized at this stage. Ask Apple and Microsoft if their operating systems have backdoors as closed OS ? Do they respect privacy of clients and do they cooperate illegally with intelligences in us , eu? Check apple phones market share dynamics in usa and other regions ..ASK USA AND EU OFFICIALS AND APPLE , AMAZON, FACEBOOK , MICROSOFT, GOOGLE IN THE FORM A NETWORL WITH USA , EU , UK INTELLIGENCE. TODAY ONE SHOULD TRUST ONLY OPEN SOFTWARE AS CLOSED OS , ENCRYPTION ALGORITHMS NAVE BACKDOORS BY DESIGN , SO UBUNTU OS, MAYBE BROWSER VPN MAY KEEP YOU SAFE AS SNOWDEN SUGGESTS.

“When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money” - Boston Fed

Nun kommt FOMO

Die grösste Baisse aller Zeiten hat begonnen

Noch ist der Gebert-Indikator auf Minus.