Coinbase Unveils "Base App," Announces Stronger Push into Social

- Lesezeichen für Artikel anlegen

- Artikel Url in die Zwischenablage kopieren

- Artikel per Mail weiterleiten

- Artikel auf X teilen

- Artikel auf WhatsApp teilen

- Ausdrucken oder als PDF speichern

It’s official: the U.S. finally has stablecoin legislation.

Last night, the House passed the GENIUS Act, marking the first clear regulatory framework for stablecoins in the U.S. Trump is expected to sign it into law tomorrow. Add the CLARITY Act, also passed by the House and now heading to the Senate, and it’s safe to say: Crypto Week delivered.

One clear winner is Ethereum which has finally found a narrative that is sticking: “stablecoin and tokenization chain”.

Soon, Wall Street might also call it the “cryptocurrency that yields.” Just yesterday, Nasdaq filed an updated 19b-4 to add staking to BlackRock’s iShares Ethereum Trust.

The Bloomberg guys think ETH staking ETFs could be approved by year-end. We believe them.

Today, we’ll also talk about:

- Coinbase unveils “Base App”

- Exclusive interview: Stablecoin banking app raises $12.5M Series A

HIGH SIGNAL BITES

- SharpLink becomes largest ETH holder among corporate entities. With over 280k ETH, the company has officially overtaken the Ethereum Foundation. In today’s Proof of Talk with MarketVector’s Martin Leinweber (see below), we take a closer look at the risks behind crypto treasury companies.🥇

- Bitcoin Standard Treasury Company to go public via SPAC merger. Led by CEO Adam Back and sponsored by Cantor Fitzgerald, the firm will launch with the fourth-largest corporate Bitcoin treasury, holding over 30,000 BTC. It also plans to raise $1.5 billion through PIPE financing — the largest PIPE ever announced.🟠

- More crypto companies are planning IPOs. Beyond asset manager Grayscale, crypto lender Figure Technology revealed plans for a public offering.💰️

- Coinbase’s Base becomes one of the fastest EVM chains. With the launch of “Flashblocks” on the Layer-2’s mainnet, it has reduced its block times from 2 seconds to just 200 milliseconds.⚡️

APPLICATION LAYER

Coinbase Unveils "Base App," Announces Stronger Push into Social

Base, upgraded: At its “A New Day One” event on Wednesday, Coinbase unveiled a major revamp of its Base division. The announcement included an overhauled Coinbase Wallet (now the Base App), core network upgrades, and a new suite of developer primitives, all aimed at accelerating adoption of its onchain ecosystem.

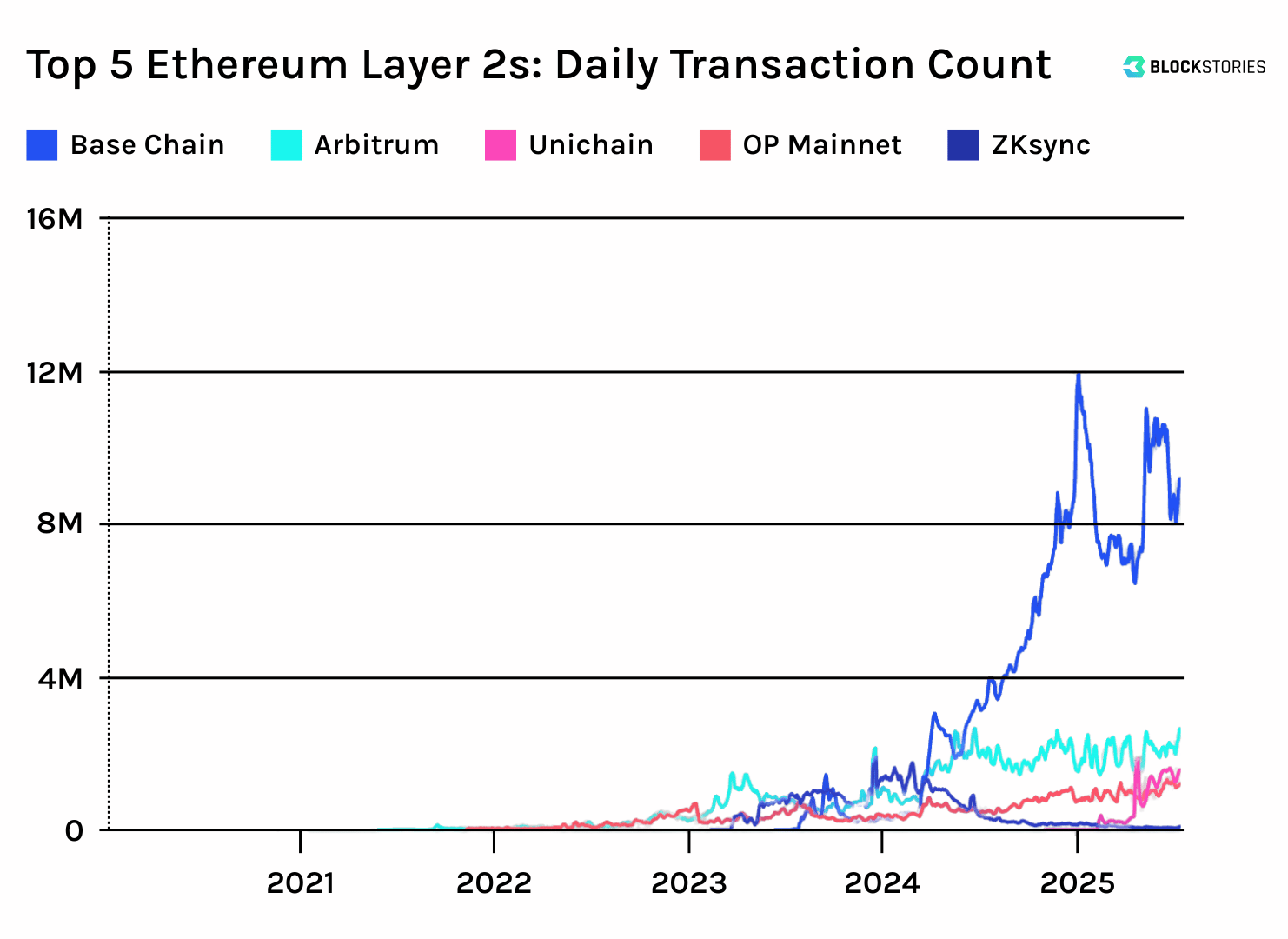

- Why it matters: When the Base team was formed in August 2022, its mandate was to build a secure, scalable Ethereum Layer-2 for Coinbase. And it delivered. Today, Base is the most active Layer-2 by daily transactions. Now, Coinbase is expanding the division’s focus beyond infrastructure, aiming to drive greater distribution for developers and apps on the network.

7-day moving average of daily transactions on leading Ethereum Layer-2s, by growthepie.xyz

Super app: At the center of this shift is the new Base App, an “onchain super app” that turns the former Coinbase Wallet into a platform for trading, payments, social, and chat:

- Social: The app features a social feed powered by Farcaster, where every post is tokenized through the Zora protocol. Users can collect or trade content directly within the feed.

- Payments & Chat: Messaging is enabled via the XMTP protocol, allowing for end-to-end encrypted chat and USDC payment. Users can also interact with AI agents like Bankr, which can execute trades and manage funds on their behalf.

CEO comments: "It kind of brings together these decentralized protocols into one easy-to-use package, trying to create the Netscape or the iPhone moment for onchain technologies,” noted Coinbase CEO Brian Armstrong.

Built-in distribution: Armstrong also pointed to synergies within the Base ecosystem: “Through our acquisition of Spindl, we now have an onchain ad network, so you can actually promote your apps through the feed if you want.”

Base Account: At the heart of the new app is the Base Account, a portable onchain identity that lets users save personal information like name, email, and address, and carry it across any app.

- One-click login: The Base Account also what powers the new “Sign in with Base” feature — Coinbase’s equivalent of “Sign in with Google” — enabling one-click registrations across platforms.

Base Pay: Building on this identity layer, Coinbase is launching Base Pay, an express checkout system for USDC payments. Already integrated with Shopify, it will soon offer a 1% cashback campaign for U.S. users to help drive adoption.

What’s next: The Base App beta is now rolling out to everyone on the waitlist, with no exact timeline being given for the full launch.

Maximilian Vargas is the founder and CEO of Blockstories.

With the rise of embedded wallets like Privy, traditional wallets have arrived at a crossroads, as their role as mere connectors to external apps is fading. To survive, wallets must become "destinations" where users engage directly.

Coinbase gets it. The Base App consolidates social, creation, messaging, identity, and payments into one consumer interface, keeping engagement on-platform and routing every action through its own Layer-2.

Still, betting on web3 social is a risky play. It’s a category outside Coinbase’s core DNA, and one that hasn’t yet proven product-market fit. But if it works, it could push Base into the mainstream and generate far more L2 sequencer revenue than a purely DeFi-focused strategy ever could.

Longer term, it also sets the stage for a second business model: onchain ad monetization. With Spindl integrated into the Base feed, Coinbase has planted the infrastructure for a native ad network, turning attention into another flywheel for Base.

ONCHAIN BANKING

Stablecoin Banking Platform Dakota Closes $12.5M Series A — Interview with CEO Ryan Bozarth

Stablecoin banking fundraise: On Tuesday, Dakota announced a $12.5 million Series A to expand its stablecoin-powered business banking platform. The round was led by CoinFund, with participation from 6th Man Ventures, Triton Ventures, and DCG.

- Why it matters: Dakota is part of a new generation of fintechs that combine stablecoin infrastructure with traditional banking rails to offer businesses a full-stack operating account that supports fiat, stablecoins, and treasury management in a single system.

Experienced team: The platform already serves over 500 businesses and has processed billions in transaction volume. Its co-founders, Ryan Bozarth and Gabe G’Sell, bring a strong entrepreneurial track record. Bozarth previously served as CEO of Coinbase Custody, while G’Sell’s last startup, Deco, was acquired by Airbnb.

Interview: We sat down with Ryan Bozarth to explore how Dakota’s architecture bridges stablecoins and traditional payment rails and what makes their model different from neobanks and crypto-native platforms.

On Dakota’s core architecture:

- “When a customer sends in a dollar, those funds are programmatically swept to a broker-dealer account and used to buy U.S. Treasuries. In return, the customer receives an on-platform stablecoin that represents their share of those bond. The result is that we can offer a dollar-denominated account with much higher speed, transparency, and flexibility than traditional banking infrastructure.”

How Dakota differs from neobanks and crypto-native stablecoin platforms:

- “Some platforms lean fully into crypto. Others are just wrappers around a single bank. Dakota is built differently. We integrate both stablecoin infrastructure and traditional payment rails like ACH, Fedwire, SEPA, and SWIFT. That means you can send USDC to a contractor or pay a law firm in euros and Dakota handles the routing and conversion behind the scenes. Our goal is to let any global business operate as if it were local, no matter the currency, asset, or payment rail.”

On the features Dakota uniquely unlocks:

- “Because we built from the ground up, we’re not just another bank account. We’re starting to collapse FX services, brokerage-style treasury management, and even more advanced workflow automation into one system. For example, we can let a U.S. business make a euro payment that lands in minutes by routing stablecoin rails to a European bank partner and converting on the last mile.”

How Dakota manages customer privacy:

- “Every customer is assigned a segregated onchain address, like you’d see with qualified crypto custodians. That gives you transparency without being publicly linkable. And when you bridge between crypto and fiat, there’s already a layer of privacy built in. We’re always making improvements, but we think this is the right approach, and we’re actively tracking new privacy tech.”

On the future of corporate treasury management:

- “Corporate treasury won’t be a static account with a fixed yield. It’ll be dynamic, responsive, and personalized, with allocations across treasuries, money markets, bonds, and crypto based on business-defined parameters. Rebalancing will happen in real time, guided by market shifts and agentic workflows.”

On the biggest opportunities in stablecoin infrastructure:

- “There’s still a gap in liquidity management, especially across multiple stablecoins, chains, and asset classes like tokenized treasuries. The dollar is well-covered, but we see a lot of potential in euro, GBP, and other regional stables too. FX remains one of the biggest whitespace areas.”

Alex Felix is the CIO of CoinFund, a leading crypto investment firms backing 100+ companies with over $550 million across venture and liquid investment strategies.

At the heart of Dakota’s product is a shift in architecture. Traditional accounts are private ledgers managed by individual banks. Moving money between them requires reconciliation, which involves intermediaries, delays, and manual checks. Wallets, on the other hand, are pointers to value on a shared global ledger. Transfers are final. Reconciliation is unnecessary. Audits are built into the system.

Dakota is turning this architectural insight into a working product: a business account that supports both fiat and crypto, connects to local payment rails, and enables companies to move value with the ease of moving data.

We believe this is what modern financial infrastructure should look like. Not a neobank with a new interface, but a smarter foundation.

Spiko | $22 million | Series A : Tokenization platform offering access to tokenized U.S. and EUR treasuries.

XMTP | $20 million | Series B : Leading decentralized messaging protocol.

Blockskye | $15.8 million | Series C : Platform helping enterprises to streamline their travel systems by using blockchain-based tools to book flights, process payments, and manage travel expenses.

Function | $10 million | Seed : Developer of FBTC, a wrapped Bitcoin product with a focus on institutions and DeFi integrations.

A conversation with Martin Leinweber, Director of Digital Asset Research & Strategy at MarketVector Indexes, on the growing number of crypto treasury companies.

|

Unironically, I think most alt-L1s will become L2s @Celo showed the playbook: The House just made history by passing major legislation on stablecoins (GENIUS Act) and market structure (CLARITY Act) in an overwhelmingly bipartisan way. This is a huge moment for crypto and for all Americans. We’re very close to having comprehensive, proactive rules in place — Chris Dixon (@cdixon) 8:13 PM • Jul 17, 2025 |

Crypto venture is quietly undergoing a radical transformation Fund sizes are compressing, strategies are shifting, and new winners are emerging Why? 1/ The set of risks that VC's get paid to take is evolving - and that changes everything — Regan Bozman (@reganbozman) 2:40 PM • Jul 17, 2025Yesterday, the Ethereum Foundation (EF) published a blog announcing intent to go all-in on integrating zero-knowledge (zk) into the Ethereum L1: |

Disclaimer: The information provided in the Crypto Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.

Powered by beehiiv