- Datum26.02.2026

- Uhrzeit17:00 - 17:30 Uhr

- Veranstalter

stock3

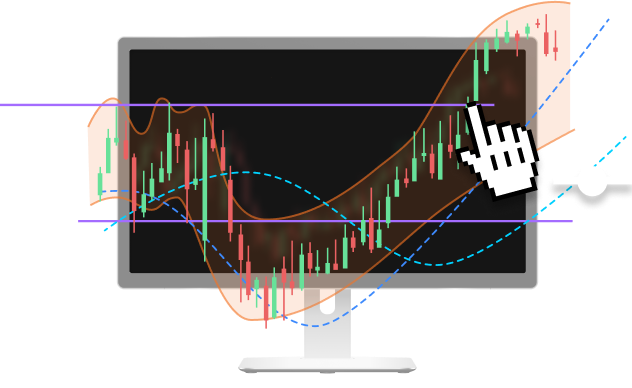

AG Mortgage Investm.Trust Inc. Chart inkl. Chartanalyse

Charts analysieren

wie die Profis?

Nutze unser Profi-Charting-Tool für Deine eigenen Analysen

AG Mortgage Investm.Trust Inc. Realtime-Kurs

| Handelsplatz | Kurs | +/- (%) | +/- (abs) | Vortag | Zeit | Aktionen |

|---|---|---|---|---|---|---|

| L&S | VK | |||||

| Tradegate BSX | VK | |||||

| gettex | VK |

Passende Produkte

| WKN | Long/Short | KO | Hebel | Laufzeit | Bid | Ask |

|---|

Wertentwicklung (NYSE)

Passender Service zu AG Mortgage Investm.Trust Inc.

Webinar zu AG Mortgage Investm.Trust Inc.

Kursinformationen (NYSE)

- Tagestief / Hoch ($)-

- 52W-Tief / Hoch ($)5,625-9,270

- Jahrestief / Hoch ($)---

- Schlusskurs (Vortag)

- Eröffnungskurs

- Volumen Intraday

Wichtigste Eigenschaften

Dividenden von AG Mortgage Investm.Trust Inc.

| Ex-Datum | Fiskaljahr | Dividende | Rendite |

|---|---|---|---|

| 31.12.2025 | 2026 | 0,23 $ | 2,61 % |

| 30.09.2025 | 2026 | 0,21 $ | 2,77 % |

| 30.06.2025 | 2025 | 0,21 $ | 2,64 % |

| 31.03.2025 | 2025 | 0,20 $ | 2,67 % |

| 31.12.2024 | 2025 | 0,19 $ | 2,78 % |

| 30.09.2024 | 2025 | 0,19 $ | 2,44 % |

| 28.06.2024 | 2024 | 0,19 $ | 2,83 % |

| 27.03.2024 | 2024 | 0,18 $ | 2,97 % |

| 28.12.2023 | 2024 | 0,05 $ | 0,78 % |

| 29.11.2023 | 2024 | 0,05 $ | 0,96 % |

| 02.11.2023 | 2023 | 0,08 $ | 1,57 % |

| 02.01.2024 | 2023 | 0,05 | - |

| 28.09.2023 | 2023 | 0,18 $ | 3,21 % |

| 29.06.2023 | 2023 | 0,18 $ | 2,86 % |

| 30.03.2023 | 2023 | 0,18 $ | 3,15 % |

| 02.01.2023 | 2022 | 0,18 | - |

| 29.12.2022 | 2022 | 0,18 $ | 3,30 % |

| 29.09.2022 | 2022 | 0,21 $ | 4,29 % |

| 29.06.2022 | 2022 | 0,21 $ | 2,94 % |

| 30.03.2022 | 2022 | 0,21 $ | 2,20 % |

| 29.09.2021 | 2021 | 0,21 $ | 1,84 % |

| 03.01.2022 | 2021 | 0,21 | - |

| 30.12.2021 | 2021 | 0,21 $ | 2,00 % |

Termine von AG Mortgage Investm.Trust Inc.

- Feb17AG Mortgage Investm.Trust Inc.

Beschreibung

TPG Mortgage Investment Trust Inc operates as a residential mortgage real estate investment trust in the United States. Its investment portfolio comprises residential investments, including non-qualifying mortgages loans, government-sponsored entity non-owner occupied loans, re/non-performing loans, land related financing, and agency residential mortgage-backed securities; and commercial investments. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was incorporated in 2011 and is based in New York, New York.